Property Financial Investment in New York City State: A Comprehensive Guide

Property investment in New york city State provides incredible possibilities for both beginner and experienced investors. With its diverse home markets, varying from high-demand urban areas to captivating rural regions, the state gives a variety of financial investment methods to construct wealth. Whether you have an interest in rental properties, business real estate, or long-lasting admiration, New York State's special landscape makes it a prime area genuine estate investment.

This guide checks out why investing in realty in New York State is a great possibility, key investment markets, and approaches to optimize your returns.

Why Buy New York City State Realty?

1. Diverse Market Opportunities

New york city State's diverse location provides a series of investment possibilities. From the dynamic roads of New York City to the scenic landscapes of Upstate New York, capitalists can pick from domestic, commercial, and industrial realty markets. Each area comes with its very own advantages and growth potential.

New York City: The city's realty market is known for its high demand, substantial home admiration, and capacity for rewarding rental income.

Upstate New York City: Markets like Albany, Saratoga Springs, and Buffalo use lower access expenses and attractive returns as these locations experience growing need for real estate and commercial rooms.

Suburbs and Smaller Sized Cities: Locations such as Westchester County, Rockland Area, and Long Island offer excellent financial investment opportunities with suv appeal and closeness to major work hubs.

This variety allows financiers to pick markets that line up with their financial investment techniques and economic goals.

2. Stable Building Admiration

One of the most significant advantages of purchasing New york city State realty is the possibility for residential or commercial property recognition. In numerous locations, specifically urban markets, realty worths have actually regularly increased over time. Also in smaller towns and rural areas, constant appreciation is common, driven by ongoing development and financial development.

3. High Rental Demand

New York State is home to a big populace of occupants, making it an ideal location for financiers curious about rental buildings. In city areas like New York City, rental demand remains high because of the influx of experts, trainees, and vacationers. At the same time, in Upstate New york city, rental markets are being driven by a mix of university towns, seasonal tourism, and regional citizens trying to find cost effective housing.

4. Economic and Job Growth

The state's economic climate is diverse, ranging from financial services and technology in New york city City to production and farming in Upstate New York. This economic diversity creates a stable setting genuine estate financial investment, with consistent need for both industrial and properties.

Trick areas such as Albany, Syracuse, and Rochester are likewise taking advantage of considerable development and job production, more sustaining the demand for real estate.

5. Desirable Tax Benefits for Capitalists

Investor in New York State can benefit from several tax obligation rewards and deductions, such as home mortgage rate of interest, home depreciation, and upkeep costs. Additionally, 1031 exchanges enable capitalists to postpone funding gains taxes by reinvesting in comparable residential properties, making it simpler to expand your profile without an instant tax worry.

Top Investment Markets in New York City State

1. New York City

The New york city City realty market is world-renowned for its high residential or commercial property worths and strong rental need. While entry prices are steep, capitalists can take advantage of considerable rental income and lasting gratitude. Neighborhoods such as Manhattan, Brooklyn, and parts of Queens supply excellent chances for both residential and industrial investments.

Multifamily residential properties: A popular option for capitalists searching for capital.

Commercial realty: Office complex, retail spaces, and mixed-use residential properties are also profitable alternatives.

2. Upstate New York

Regions in Upstate New york city are obtaining grip due to their cost and development potential. Cities like Albany, Buffalo, and Syracuse are experiencing financial revitalization, with more people transferring to these locations as a result of lower living expenses contrasted to New York City.

Buffalo: This city is seeing a Green Springs Capital Group revival in realty financial investment because Green Springs Capital Group of recurring midtown revitalization initiatives and an increase in technology and clinical sectors.

Saratoga Springs: Recognized for its tourist and seasonal tourist attractions, Saratoga Springs has a robust rental market, especially for getaway residential or commercial properties and short-term leasings.

Rochester: With its solid educational institutions and making industries, Rochester is one more eye-catching location for investors looking for budget friendly properties with appealing returns.

3. Long Island

Long Island offers a balance in between rural living and proximity to New york city City. With its highly preferable communities and solid rental demand, especially in locations near to the city, Long Island presents possibilities for both domestic and commercial real estate investors.

Nassau Area: A prime location for single-family homes and luxury residential or commercial properties.

Suffolk Region: Offers a mix of suv and country real estate chances, with boosting demand for holiday rentals.

Trick Approaches for Real Estate Financial Investment in New York City State

1. Buy-and-Hold Approach

The buy-and-hold technique is among the most trusted ways to build long-term wealth in New york city State's property market. Financiers acquisition residential or commercial properties, rent them bent on renters, and take advantage of both rental revenue and property gratitude in time. This technique functions particularly well in regions where rental need is high, such as New York City City and Upstate New York.

2. Rental Building Financial Investment

Investing in rental homes is a prominent technique, especially in markets with strong renter need. Urban areas like New York City, as well as expanding cities like Buffalo and Albany, give opportunities for high rental returns. Capitalists can take into consideration:

Multifamily residential or commercial properties: Ideal for creating numerous earnings streams from one structure.

Single-family homes: Popular in suburban areas with family-oriented tenants.

3. Vacation Leasings

For investors thinking about temporary rental revenue, areas like Saratoga Springs, Hudson Valley, and The Catskills supply significant capacity. These locations attract vacationers year-round, permitting property owners to maximize high rental need during peak periods.

4. Industrial Property

New york city State's economy is a center for organizations, making commercial property investments a rewarding option. Office spaces, retail structures, and stockrooms are in need in significant cities and expanding communities alike.

5. Home Flipping

Financiers seeking quicker returns can pursue home flipping in markets with growing need. Acquiring undervalued buildings, remodeling them, and selling them for a earnings is a strategy that works well in areas undergoing economic https://sites.google.com/view/real-estate-develop-investment/ revitalization, such as Buffalo or Rochester.

Challenges to Consider

While property in New york city State supplies substantial possibilities, there are some obstacles:

High real estate tax: New York is recognized for having several of the highest possible real estate tax in the united state, which can affect revenue margins.

Laws: The state has strict regulations, especially in the rental market, consisting of lessee defenses and lease control legislations.

Market competition: In popular locations fresh York City, competitors for residential properties can be strong, resulting in higher rates and bidding process wars.

Conclusion

Investing in New york city State realty provides a wealth of possibilities throughout a variety of markets. Whether you're targeting high-demand city buildings in New york city City or exploring the growth potential of Upstate New york city, real estate is a tried and tested technique for constructing long-term wide range. By selecting the ideal market, embracing a strong financial investment method, and handling your assets successfully, you can create significant monetary returns in this vibrant and varied realty landscape.

Rick Moranis Then & Now!

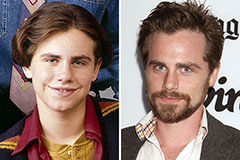

Rick Moranis Then & Now! Rider Strong Then & Now!

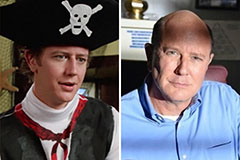

Rider Strong Then & Now! Judge Reinhold Then & Now!

Judge Reinhold Then & Now! Marla Sokoloff Then & Now!

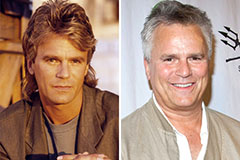

Marla Sokoloff Then & Now! Richard Dean Anderson Then & Now!

Richard Dean Anderson Then & Now!